How do I customize a layout template for my quotes and invoices?

With Toolcie, you can fully customize layout templates for your quotes and invoices.

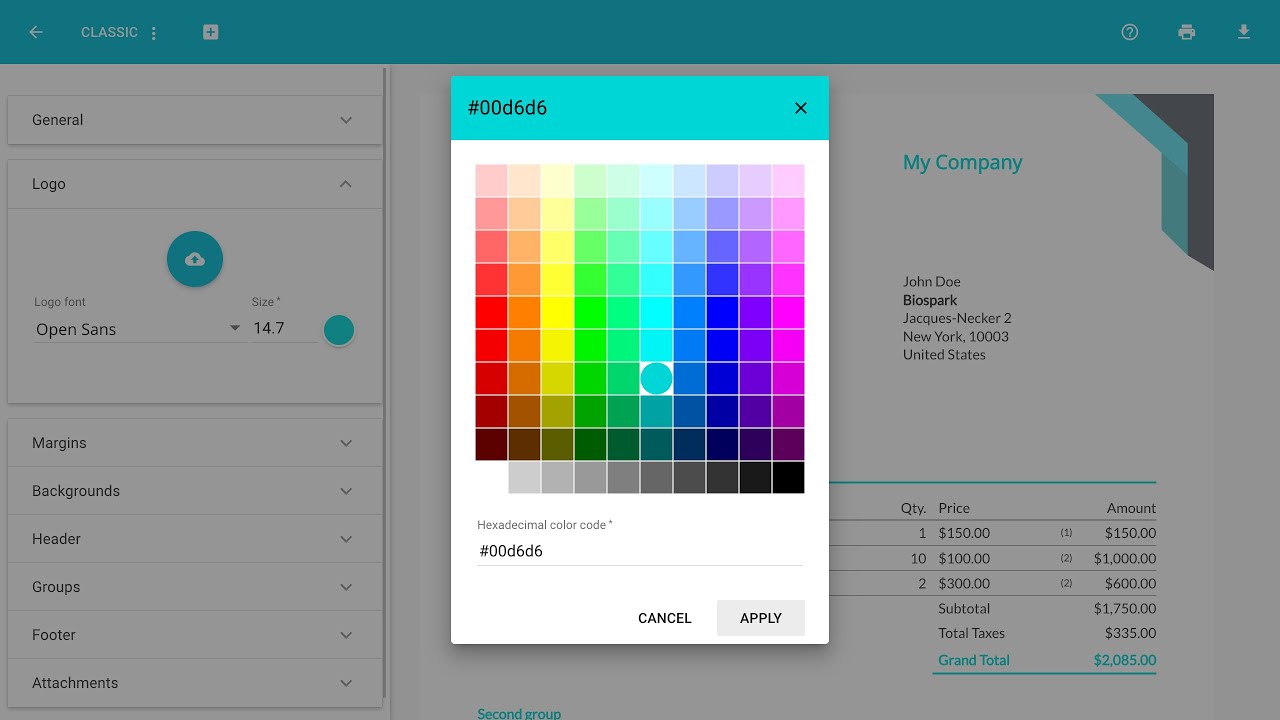

Among other things, you can modify the following:

- fonts of text and titles

- colors of the text, backgrounds, and borders

- select the font size

- change the location of page elements or hide them

- select a background for the header and footer, and select an overall background pattern

- select the exact location to display the customer’s address

- add your logo and change its size

- insert attachments before and after your documents to add a cover page or your company’s brochure

- choose from over 14 ready-to-use templates

- set distinct templates for your quotes and invoices

- and much more.

You can customize your layout templates via the menu:

- Settings > Quotes > Layout template (dropdown list)

- Settings > Invoices > Layout template (dropdown list)

You can also access these settings while in editing mode for a quote or invoice by clicking: Settings > Layout template (dropdown list).

“Import an attachment” button.

“Import an attachment” button. then on the “Recurring invoice”

then on the “Recurring invoice”